Navigating Global Economics: A Central Hub

The evolving landscape of global financial transactions demands a robust and strategically positioned hub. This platform serves as a vital gateway, facilitating smooth movement of capital across borders and fostering strong transnational collaboration. It's not merely about facilitating payments; it's about providing innovative risk management tools, expert guidance, and fostering innovation within the industry. A true strategic hub must also be adaptable, capable of responding swiftly to shifts in regulatory environments and embracing developing technologies to maintain a leading edge. Furthermore, it acts as a focal point for drawing investment and building lasting relationships with key stakeholders. This hub represents more than just framework; it embodies a commitment to assurance and sustained development within the global economy.

Savvy Investment: Your Pathway to Expansion

Navigating the challenging world of finance can Renewable Energy Investment feel overwhelming, but thoughtful investing doesn't have to be. Building wealth is a endeavor that requires more than just putting money into assets; it demands a calculated approach, one that considers your unique goals and tolerance. Focusing on intelligent investment strategies, such as diversification and long-term planning, can help you boost your potential for gains and achieve your financial aspirations. Don't just save; invest prudently and watch your prosperity blossom.

Decoding Financial Markets : Expert Perspectives

Navigating the complexities of today's financial landscape can feel like interpreting a cryptic code. But don’t despair – seasoned professionals are offering valuable advice to help investors gain a clearer picture. A recent assessment highlighted that many individuals struggle with predicting trading fluctuations, often reacting emotionally rather than strategically. These knowledgeable voices emphasize the importance of fundamental analysis, considering financial indicators and company performance, alongside a careful approach to risk management. The essential takeaway? Successful investing isn’t about chasing fleeting trends; it’s about developing a well-informed and sustainable strategy – and having the confidence to stick to it, even when turbulence reigns.

Sustainable Returns: Investing in Renewable Energy

The burgeoning demand for cleaner power presents a compelling opportunity for investors seeking both financial gains and a positive environmental influence. Investing in renewable power – encompassing solar, wind, hydro, and geothermal – isn't just a feel-good endeavor; it's increasingly demonstrating its potential for strong returns. Historically, the sector faced volatility, but advancements in technology and increasing government incentives have significantly improved the outlook. Many funds and individual stocks focusing on renewable developers are now offering competitive yields, fueled by long-term contracts and falling production costs. Diversifying your portfolio with a selection of these assets can offer a hedge against traditional fossil fuel volatility and contribute to a more sustainable planet, while simultaneously bolstering your financial well-being. Careful research is, of course, crucial to identifying promising opportunities within this dynamic arena, but the overall potential for generating sustainable returns remains highly appealing .

Powering the Future: Renewable Energy Investment Opportunities

The growing global shift towards sustainability presents substantial investment opportunities within the renewable energy sector. From sun farms and wind turbines to hydroelectric projects and geothermal plants, the demand for clean energy is fueling unprecedented growth and innovation. Investors can explore a range of avenues, including direct investment in emerging renewable energy infrastructure, funding in publicly traded companies focused on clean power generation, or even contributing to innovative technologies like energy storage solutions. The potential for favorable returns, coupled with the positive environmental impact, makes renewable energy a compelling area for both institutional and retail investors seeking to profit from the change to a more sustainable future. However, it's important to understand the inherent risks involved, including regulatory uncertainties and the changing nature of commodity prices.

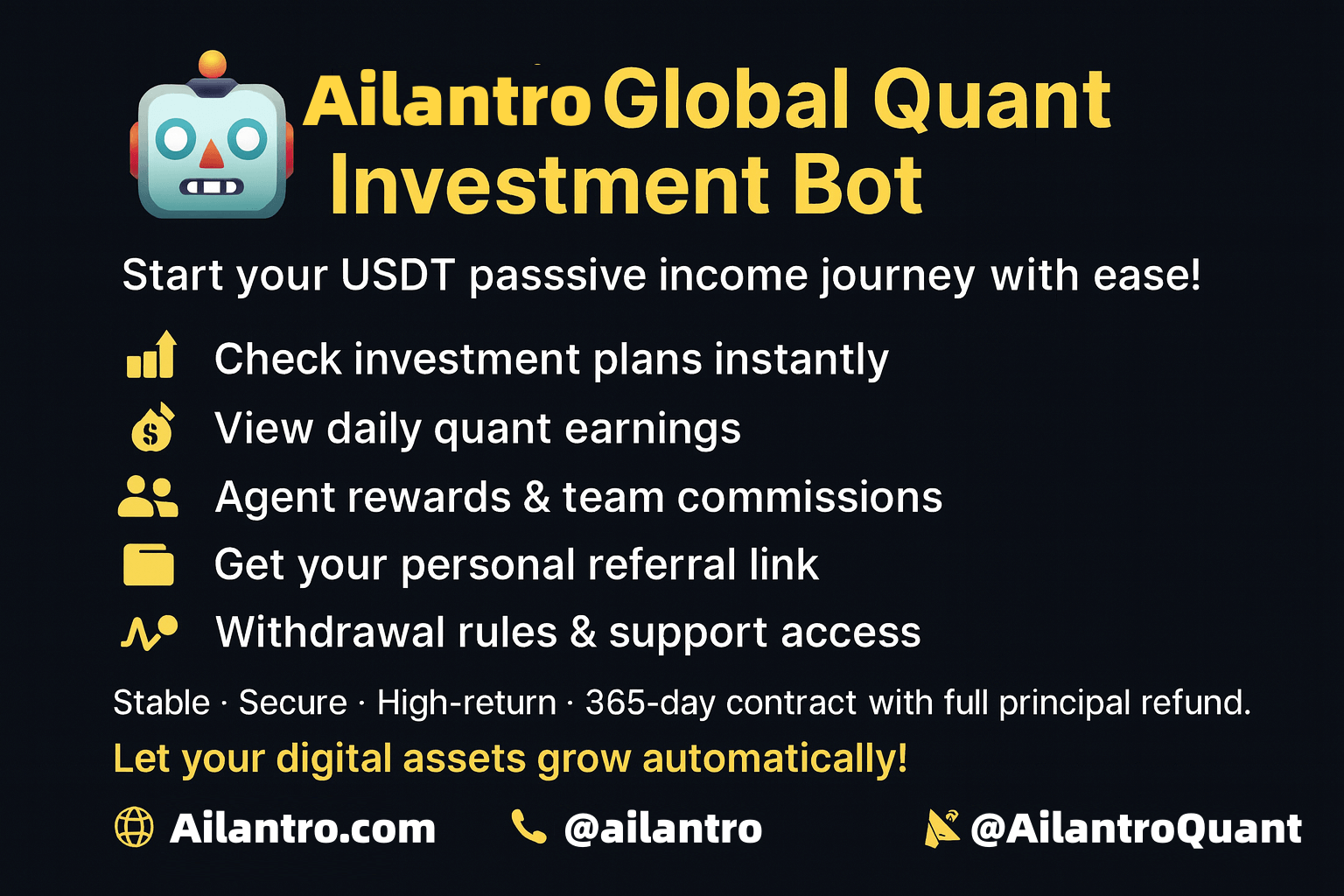

The Sophisticated Money Solution: Capitalizing International Trends

The rapid evolution of digitalization is fundamentally reshaping the monetary landscape, creating unprecedented opportunities for those who can adapt. Our solution is engineered to take advantage of these international trends, providing clients with the tools to navigate a complex market. We're prioritizing on key areas such as blockchain assets, ethical investing, and the growing role of algorithmic intelligence. By combining modern analytics and a user-friendly interface, our finance platform enables individuals and organizations to make informed decisions and achieve their financial goals in a unpredictable world. The ability to adapt quickly to economic fluctuations is no longer a luxury; it’s a necessity, and we’re committed to providing the infrastructure for growth in this new era.